Coronavirus and the Conservation Finance Community

An Online Discussion Series

There is no doubt that COVID-19 is having far reaching impacts on the global stage. Ranging from the healthcare sector to the global economy, and from climate change to our own interpersonal daily lives as we adjust to this ‘new normal’, the impacts of the novel coronavirus will surely be felt for the coming years. Through this Online Discussion Series, members of the CFA come together to explore how COVID-19 is impacting local, national and global efforts towards conservation finance.

1st Online Discussion: Coronavirus and Conservation Trust Funds

Key Points | Link to recording

2nd Online Discussion: Identifying robust Conservation Finance Mechanisms

Key Points | Link to recording

3rd Online Discussion: Public-Private Partnerships

Key Points | Link to recording

4th Online Discussion: Mainstreaming Biodiversity in Development

Key Points | Link to recording | Download Presentation

5th Online Discussion: Blended Finance

Key Points | Link to recording

____________________________________________________________________________________________________________________________________________

The fifth Online Discussion concluded on July 31st

This is one is three discussion assessing various finance mechanisms that are seen as robust in the face of the COVID19 pandemic.

Panelists:

Adhiti Gupta - Convergence

Gregory Watson - Natural Capital Labs, IDB

Avril Benchimol - Blended Finance, Global Environment Facility

This discussion focused around assessing the opportunities and challenges of Blended Finance.

Blended Finance is defined as “the use of catalytic capital from public or philanthropic sources to increase private sector investment in sustainable development” (Convergence). This was one of the conservation finance mechanisms that remains potentially robust despite the current Covid19 pandemic (see CFA Covid discussion). Three panelists coming from diverse organizations active in this area will discuss the benefits and challenges of Blended Finance as a conservation finance mechanism. They will discuss, in the time of coronavirus, how Blended Finance can be used to ensure the continuation of capital flows and alignment of incentives in conservation worldwide. Some specific topics may include how the current Covid19 pandemic has impacted the formation and execution of Blended Finance mechanisms. As well, looking ahead, what are some of the lessons learned as a result of this pandemic that can help strengthen Blended Finance mechanisms.

Our first panelist, Adhiti Gupta, introduced the concept of Blended Finance and offered key data points from Convergence with regards to the increasing capital being catalyzed through blended finance transactions, especially in light of the COVID19 pandemic.

Following our first panelists, Gregory Watson and Avril Benchimol discussed the various operations of their respective organizations, the Global Environment Facility and the Inter-American Development Bank. This webinar followed a different approach as compared to previous webinars, as this webinar was structured as a conversation between the panelists and the moderator, with the moderator posing questions throughout the discussion.

____________________________________________________________________________________________________________________________________________

The fourth Online Discussion concluded on July 10th

This is one of three discussions assessing various finance mechanisms that are seen as robust in the face of the COVID19 pandemic.

Panelists:

Tracey Cumming - Expert on Biodiversity Finance CBD, and Technical Advisor to BIOFIN (Biodiversity Finance Initiative)

Onno van den Heuvel - Manager, BIOFIN (Biodiversity Finance Initiative), UNDP

Katia Karousakis - Biodiversity Team Leader, OECD Environment Directorate, OECD

This discussion focused around assessing the opportunities and challenges of mainstreaming biodiversity in development.

Mainstreaming Biodiversity in Development is a broad category of strategies that supports the alignment of diverse interests towards multiple sustainable development objectives. Some examples for conservation include prioritizing nature based solutions to climate change, integrating watershed management with urban development, integrated planning for SDG targets at the national level, etc. This was one of the conservation finance mechanisms that remains potentially robust despite the current Covid pandemic (see CFA Covid discussion). Three knowledgeable panelists will discuss the benefits and challenges of Mainstreaming Biodiversity in a time of COVID19. They will discuss how mainstreaming assures that investments in nature (including recovery efforts) provide essential cobenefits for other sustainable development objectives.

Our first panelist, Tracey Cumming, introduced the broad concept of Mainstreaming Biodiversity and provided significant context on various questions surrounding the mainstreaming of biodiversity. She also provided insight into the issues deserving immediate attention with regards to mainstreaming, including how to link the sovereign debt crisis and the enhancement of biodiversity, and the need to ensure recovery/stimulus packages as a result of COVID19 are biodiversity positive.

Our second and third panelists, Onno van den Heuvel and Katia Karousakis, focused on how organizations such as BIOFIN are implementing these strategies on the national level, and how to better monitor progress on mainstreaming biodiversity in the post-2020 global biodiversity framework.

____________________________________________________________________________________________________________________________________________

The third Online Discussion concluded on June 18th.

This is one of three discussions assessing various finance mechanisms that are seen as robust in the face of the COVID19 pandemic.

Panelists:

Eric Carey - Executive Director of the Bahamas National Trust (BNT)

Eleanor Carter - Deputy Director of the Chumbe Island Marine Protected Areas in Zanzibar, Tanzania; and Founder and Director of Sustainable Solutions International Consulting

Nicolas Pascal - Director of Blue Finance

This discussion focused around assessing the benefits of Public-Private Partnerships (PPPs) for Marine Protected Areas (MPAs) in the face of COVID19. Public-Private Partnerships can be defined as “a long-term contract between a private party and a government entity, for providing a public asset or service, in which the private party bears significant risk and management responsibility, and remuneration is linked to performance” (World Bank), and they can play a key role in the maintenance of MPAs. Three panelists coming from diverse backgrounds within the marine conservation space discussed the benefits and challenges of PPPs in the context of the COVID19 pandemic.

The first two panelists, Eric Cary and Eleanor Carter walked the audience through two case studies of Marine Protected Areas under a PPP agreement and how they were faring due to COVID19; the Bahamas National Trust, which is a NGO charged with the management and custodianship of several protected areas throughout the Bahamas, and the Chumbe Island Coral Park, the first privately managed (by a non-profit organization) MPA in the world.

Our final panelist, Nicolas Pascal, discussed how to bridge the finance gap that most MPA’s face through various avenues such as Blended Finance schemes in order to draw investors seeking financial returns.

The second Online Discussion concluded on May 11th.

This discussion was broken into 2 parts. Part One focused on identifying individual Finance Mechanisms that are either positively or negatively impacted by the COVID19 pandemic. Part Two focused on understanding the debt accrued in both developed and developing countries as a result of the pandemic, and how this debt can be leveraged to benefit conservation and biodiversity.

Main speakers for the second discussion:

Sean Nazerali - BIOFUND Mozambique | David Meyers - Executive Director, Conservation Finance Alliance | Simon Zadek - Vivid Economics

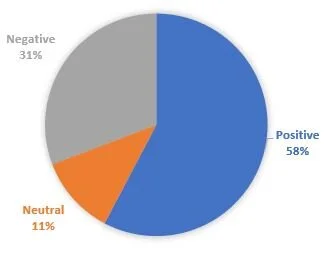

This Online Discussion had an interactive element, where participants were asked to score the 34 finance instruments outlined in the CFA White Paper “Conservation Finance: A Framework” based on how resilient the instruments are to the Coronavirus pandemic. The results of the scoring exercise are displayed below. The scoring will help form the foundation for a potential Task Force that will outline steps conservation finance professionals and practitioners can take to insulate finance flows from negative global and health crises.

Three Finance Instruments that are considered to be resilient to the Coronavirus pandemic:

Sustainable Investment Strategies

Blended Finance

Mainstreaming Biodiversity in Development

Three Finance Instruments that are considered to be prone to the Coronavirus pandemic:

Capital Markets

Debt: Leasing, Bank Loans, Notes and Trade Finance

Fees and Charges

Three Finance Instruments that are not considered to be greatly impacted (negatively or positively) by the Coronavirus pandemic:

Deposit-Refund Schemes

Management Effectiveness

Integrated Accounting

In the second part of the webinar, we heard from Simon Zadek, who spoke on aligning sovereign debt levels with increased attention towards nature and biodiversity conservation goals. Please find selected remarks below:

“The interesting question, is whether we can achieve two wins: reducing the cost of capital to developing countries while at the same time encouraging particularly biodiversity rich countries to invest more extensively in managing various aspects of nature. We are all familiar with the debt-for-nature swap agenda now going back a number of years, and the conditionality, both dual and performance related, attached to debt in previous years.

The opportunity we have over the short term, is to insert a nature component to the discussion and not drive conditionality, but to push developed countries to offer a reduced cost of capital in moving more debt towards those countries in return for a degree of nature co-benefit. The opportunity is there, though the window is quite narrow, as there will be a huge explosion of emerging market debt growth.

The Financing For Biodiversity Initiative is going to take forward the agenda, and we need actors from within both the finance and biodiversity community. We will be pushing ahead first with a technical piece and an outreach piece. We are talking about a growth or restructuring of debt. We must use this ‘Black Swan’ opportunity.”

The full recording of the Online Discussion Series is available for view here.

The first Online Discussion concluded on April 20th, and focused mostly on Conservation Trust Funds.

Main speakers for the first discussion:

Karen Price - CAFÉ | Zdenka Piskulich - RedLAC | Thierry Renaud - MAVA Foundation | Constance Corbier-Barthaux - FFEM | James Money-Kyrle - Associate Director, The Good Economy | Melissa Moye - WWF US

When looking at the current financial outlook due to the crisis, what advice could be given to Conservation Trust Funds? - James Money-Kyrle (Associate Director, The Good Economy)

Focus on your strengths. Endowments that constitute the assets of CTFs are powerful tools during this very uncertain time.

Foundations and Trusts with long term time horizons should seek to continue spending where they can, and particularly where a total return approach is used.

Avoid making snap decisions. Hasty decisions can be very costly. Use the time wisely now to make sure CTF activities and investments are aligned with respective missions or overall long-term strategy.

What unique challenges are CTFs facing in this crisis? - Zdenka Piskulich (RedLAC)

The challenges CTFs are facing are both external and internal.

Internally: Due to the crisis many fundraising campaigns have been postponed. There has also been an increase in workload, and in many cases an incapacity to fulfill previously set commitments to funders.

Externally: Many conferences have been postponed. This is especially difficult as 2020 was poised to be the Super Year for Biodiversity. Additionally, many governments are redirecting attention to the crisis, thus many agreements CTFs have with governments are now paused or being postponed.

How are CAFÉ members faring in this crisis? - Karen Price (CAFÉ)

This emergency is to a large extent something that African CTFs across the board were not financially prepared for. Few CTFs have an ‘emergency budget’ at this time. In addition, there are no operational guidelines for such a situation, leaving many CTFs attempting to navigate this crisis in accordance to how both the international community and national governments are reacting.

As a CTF, our field presence has been reduced drastically. There is still work being done with partners in Protected Areas, however the concerns around modality adjustments towards the CTFs remain.

Constance, how has FFEM reorganized funded programs around the world? - Constance Corbier-Barthaux (FFEM)

FFEM is devoted to conservation linked to development, and of course all the threats that are facing CTFs discussed earlier are large issues of concern for FFEM as well.

On a positive note, this is the time for capitalization, for exchange of ideas, new ways to communicate and exchange. The two networks, RedLAC and CAFÉ, as well as the CFA will play a central role in exploring these new ways of communication and understanding what information to share and how to share it.

What positive things can we see coming out of this current crisis? A silver lining, if you will? - Thierry Renaud (MAVA)

We are all figuring out what this situation means, as well as to try to understand the long-term impact. The good news is that CTFs, from MAVAs perspective at least, are viewed as the most resilient organizations compared to other civil society organizations. There are three main points I would like to stress when addressing CTFs and Foundations:

- There is now pressure to step up: increase investment and fill the gap, but also to give more flexibility to partners. In times of crisis, increasing the amount you give away to partners might be very important. Be part of the solution.

- Money for biodiversity will be scarce, so CTFs need to make a case that they are good investments. CTF’s need to be able to show their resilience in this crisis. This will allow CTFs to receive additional investments in the future.

- For the broader Conservation Finance community, we must do what we can to ensure that large government efforts to relaunch economies are also paying attention to biodiversity and conservation efforts.

What is the NGO perspective on the situation? - Melissa Moye (WWF-US)

One of the biggest challenges moving forward is to explore the greening of the wider global economic recovery and foreign aid process. It will be interesting to see what is going to happen with respect to conditionality attached to debt-relief.

This crisis should reinvigorate efforts to eliminate wet markets and illegal wildlife trade. This crisis shows that the closure of wet markets is essential and highlights links between deforestation and pandemics.

Indigenous peoples are more vulnerable to health issues related to COVID-19, therefore special attention must be given towards the protection of those peoples. Finally, it is interesting to note that certain donors and partners are stepping up more as a result of the crisis. We are seeing individual donors stepping up more when they see individual governments stepping back, as these donors are working harder and not letting COVID-19 disrupt and interfere with their activities.